Let’s take a look in more detail at how insurance companies view rhinoplasty surgery and what you need to do to get your functional rhinoplasty procedure covered by your insurance.

What is a functional or medical rhinoplasty?

There’s an important difference between cosmetic and functional rhinoplasty in that the former is not considered ‘medically necessary’, while the latter is.

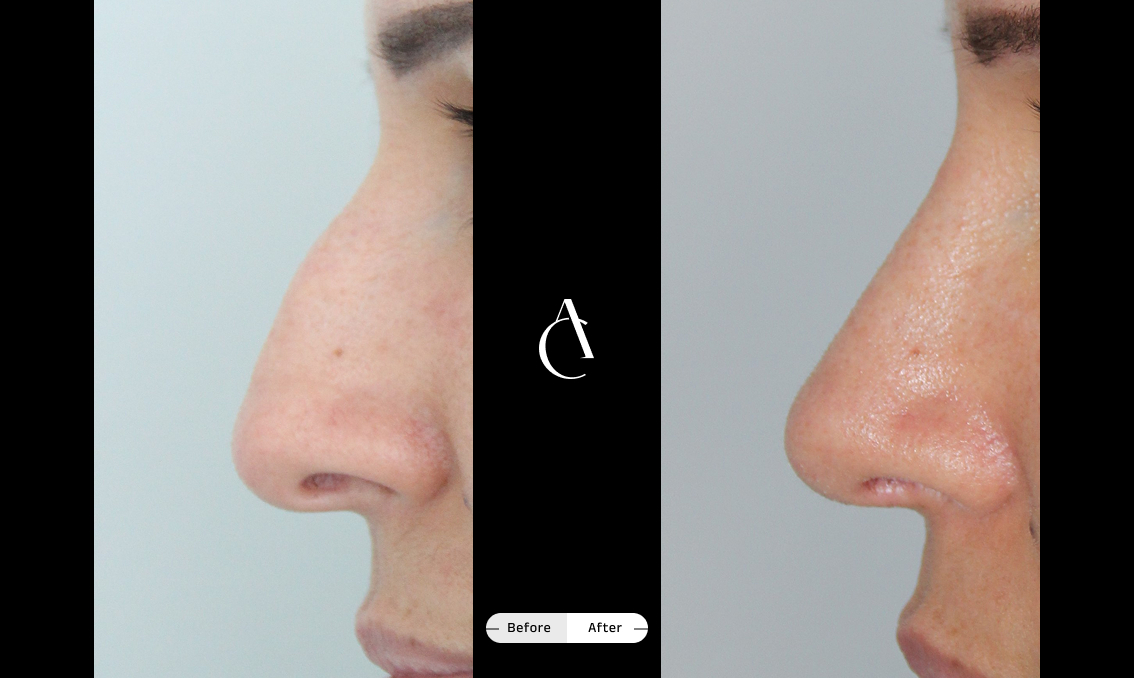

Cosmetic rhinoplasty is performed to change the appearance of your nose – such as refining the tip, reducing a bump, lifting the bridge or narrowing the nostrils – and it’s not typically covered by medical insurers.

On the other hand, a rhinoplasty is considered ‘functional’ when its primary purpose is to improve your breathing or correct structural issues inside your nose after injury or illness. It’s considered medically necessary, and so is often eligible for full or partial cover by your medical insurance.

There are a number of common medical issues a functional rhinoplasty can address, including:

- Deviated septum – this is when your septum (the wall dividing the nostrils) is crooked, blocking airflow. It can be straightened with a septoplasty procedure performed during rhinoplasty surgery.

- Nasal valve collapse – this is when the narrowest part of the airway inside your nose weakens or collapses, which may need a cartilage graft to restore airflow.

- Enlarged turbinates – this happens when the bony structures inside your nose swell and restrict breathing, requiring a turbinectomy or turbinate reduction to remove or reshape airway tissues to allow freer airflow.

- Post-trauma correction – typically needed to restore function and appearance after a broken nose as a result of a fall, accident or sports injury.

- Congenital deformities – if you’ve been born with structural irregularities in your nose, these may affect your breathing and require correction.

- Chronic sinus problems or snoring – rhinoplasty is sometimes performed at the same time as sinus surgery to improve airflow and comfort.

Needless to say, your insurance company is much more likely to cover your procedure if there’s a well-documented medical benefit, such as better breathing. In the case of rhinoplasty surgery that improves both the function of your nose and its appearance – such as a septoplasty procedure to correct a deviated septum while also reshaping the nose tip – you may be able to get an insurance payout for the functional part of the surgery while covering the cost of the aesthetic elements yourself.

How to get rhinoplasty covered by insurance

If your rhinoplasty has a full or partial functional element, these are the steps you’ll need to follow to get your insurance to cover or contribute to the costs of your surgery.

1. Get an assessment with an ENT specialist or rhinoplasty surgeon

Start by scheduling a consultation with an Ear, Nose and Throat (ENT) specialist or a plastic surgeon like Dr. Cuno. They will assess your nasal structure and breathing function to determine whether or not you have a functional issue that needs addressing through surgery.

2. Undergo medical imaging or breathing tests

These will provide the proof you need that there is a medical issue, such as an obstruction, that needs treating with surgery. These tests may include a nasal endoscopy, a CT scan or airflow measurements (known as rhinomanometry).

3. Gather documentation

Documentation from your surgeon will prove to insurers that there’s medical justification for your procedure, explaining the functional (not aesthetic) improvements the surgery will bring.

4. Submit a pre-approval request

You’ll need to submit a formal pre-approval (or prior authorisation) request to your insurer before you go ahead and schedule your surgery.

Remember, if you decide you’d like to take the opportunity of having nasal surgery to improve the appearance of your nose at the same time, your insurance will only cover the medically necessary part. The cosmetic part of the procedure will then be billed separately for you to pay yourself.

Quelle der Bilder: Freepik

Is rhinoplasty covered by insurance in Europe or Switzerland?

Insurance rules vary significantly from one country to the next. In the UK, private medical insurance may contribute only to the medically necessary part of a rhinoplasty procedure, while the NHS will only cover it when there’s a clear medical need (such as a severe breathing obstruction, trauma or congenital abnormality).

In France, Germany and Switzerland, medical justification and the required documents are vital and you’ll have to pay for cosmetic rhinoplasty procedures yourself. For functional rhinoplasty, both private insurers and public health systems in these countries will normally require you to have had a breathing impairment documented by a specialist and to have tried other, less invasive treatments first. In Switzerland, you’ll need a formal ENT medical evaluation to document the severity of any nasal obstruction.

How much does combined rhinoplasty cost with insurance?

As we’ve seen, in situations where rhinoplasty is used for both cosmetic and functional reasons, insurers may pay for the functional part while you cover the cosmetic elements yourself.

The split of the costs varies from one country and one insurer to another, with anything between 30-70% potentially being covered by your insurer if functional work is included in the surgery. The cost of the cosmetic part of your surgery depends on a number of factors, including the complexity of reshaping required, the expertise of your surgeon and the location of the clinic. Always request a split cost quote so you know what portion of the bill you’ll need to budget for.

Can insurance cover rhinoplasty after an accident or trauma?

In short, yes. Reconstructive rhinoplasty is usually eligible for cover by your insurer, typically when you’ve injured your nose in a fall, car crash, work-related accident or sports injury.

To improve your chances of having this surgery funded by your insurer, get medical care immediately after you’ve injured yourself and save all reports, such as scans, X-rays and any medical notes. The earlier you file your claim, the better, as late, undocumented claims are less likely to be successful.

Quelle der Bilder: Freepik

Rhinoplasty insurance: what documents do you need?

Here’s a checklist of the documents you’re likely to need to ensure your rhinoplasty surgery is covered by your medical insurance:

☑️ ENT or rhinoplasty surgeon evaluation report

☑️ CT scan or nasal imaging

☑️ Diagnosis of obstruction (such as deviated septum)

☑️ Cost breakdown showing functional versus cosmetic fees

☑️ Pre-authorisation form for insurance review

You’ll usually be able to get help with compiling and submitting these documents from your surgeon’s clinic.

Is rhinoplasty covered by insurance or not?

Put simply, cosmetic rhinoplasty is not medically necessary and is therefore not covered by your insurance. Functional rhinoplasty, on the other hand, is covered, with typical reasons including restoring breathing or repairing injury. If your rhinoplasty procedure will contain a mix of cosmetic and functional improvement, you may be able to get partial cover from your insurer while paying for the cosmetic element yourself.

You’ll need good documentation and proof that your procedure is medically necessary to succeed in getting your insurer to pay out, and a thorough medical evaluation is the first step.

Consult with a qualified surgeon to assess your case

The easiest way to understand your eligibility for insurance cover is to arrange a consultation with a specialist rhinoplasty surgeon like Dr. Cuno, who will review your symptoms, discuss your goals and determine whether insurance may help cover your rhinoplasty. Buchen Sie noch heute einen Termin bei Dr. Cuno.

Quelle der Bilder: Freepik